What is Marginal Productivity? Learn its Importance in Economics

Welcome to the fascinating world of economics! Today, we’re going to dive into a key concept that often comes up: Marginal Productivity. If you’ve ever wondered what this term means and how it plays a crucial role in understanding our economy, you’ve come to the right place. This article is designed to explain Marginal Productivity in an easy-to-understand way and highlight its significance in economic studies. So, sit back, relax, and let’s get started!

What is Marginal Productivity?

Firstly, we must understand the core concept of marginal productivity. In essence, marginal productivity is all about measuring the additional output resulting from hiring another worker. If a company hires an extra unit of labor, say another worker, the change in production that arises from this is termed marginal productivity. It’s a vital part of the marginal productivity theory, which is one of the many economic theories.

The marginal productivity theory offers practical insights into the effect of additional resources on the overall output. For instance, if a company is producing a certain number of goods and decides to hire one more worker for the jobs or add another unit of input, the theory helps in analyzing the resulting change in productivity. It indicates the point at which the highest level of output is achieved. Therefore, understanding and applying this theory is crucial for any production-based company.

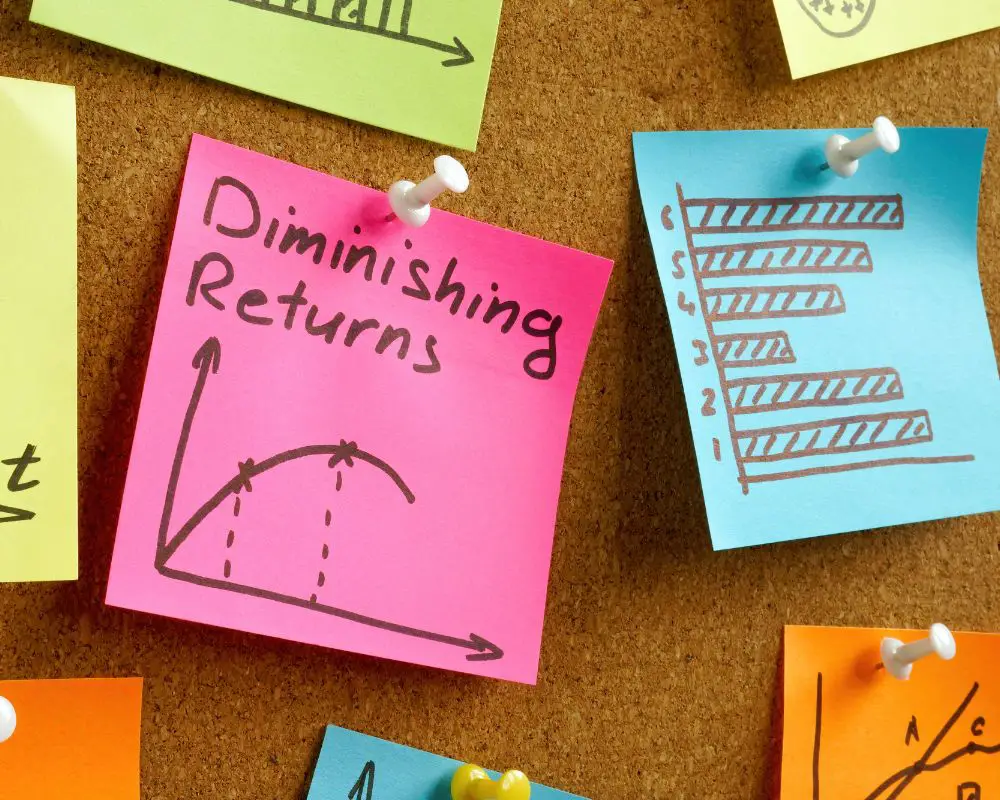

But what happens if the company keeps hiring without a limit? The theory suggests that at a certain point, each additional worker will start to contribute less to the overall output. This is because resources may become stretched, causing the return from each additional worker to decrease. The theory, therefore, stresses that while productivity might increase initially with the addition of more workers, it eventually decreases.

In conclusion, marginal productivity plays an indubitably important role in economics. It guides companies in their hiring and production decisions, informing them about the most efficient point of operation. Truly, understanding the nuances of marginal productivity is key to maximizing the productivity of any company.

Understanding the Role of Marginal Product in Company’s Capital Management

The term ‘marginal product’ may sound complex, but it’s an essential concept in both the company’s operations and capital management. Simply put, the marginal product refers to the additional output that a business gains by adding an extra factor, such as labor or capital. When a company’s management decides to add an extra unit of a factor, like machinery in a manufacturing setup, it anticipates an increase in output, also known as marginal benefits.

The dynamics of marginal product and its direct impacts on the capital management of a business are intertwined. As the company injects more capital into its operations, the marginal product often increases. This is largely due to bigger production capacities leading to additional output. However, it’s vital to note that this equation isn’t always directly proportional. At some point, the law of diminishing returns may apply. Therefore, astute capital management requires a clear comprehension of when and where the marginal product plateaus or even declines.

In essence, the marginal product plays a significant role in balancing capital investment in a business, particularly in manufacturing. A keen eye on the marginal product can inform a company’s capital management strategies, ensuring that the business resources are efficiently used to maximize the additional output. So, understanding the marginal product and its relation to the operational inputs is essential in enabling the company’s management to make strategic decisions that will optimize productivity and profitability. Consequently, it’s clear to see the importance of marginal product in a company’s capital management.

Importance of Diminishing Returns in Labor and Capital Estimation

In economics, the understanding and implementation of diminishing returns can play a critical role in labor and capital estimation, two factors that significantly impact a company’s output. Diminishing returns occur when the input in a single factor of production is increased, and all other production factors are held constant, the output then increases at a decreasing rate. This principle often shows up in instances where a company’s factor input, such as additional labor or capital, eventually results in diminished rates of output.

Consider a situation where a company is adding more employees (labor) to a project. Initially, the addition of labor increases the output. However, after a certain point, the company hits a peak—known as the point of diminishing marginal productivity—where each additional employee contributes less to output than the one before. This is largely due to the fixed amount of capital such as equipment or workspace. Every new employee has less and less capital at their disposal, thereby decreasing efficiency.

Capital estimation works in much the same way. If a company continues to increase capital, for instance, by investing in machinery, without increasing labor, it will eventually experience diminishing returns. Machines will sit idle without enough employees to operate them, leading to a waste of resources and potential inefficiency.

Both labor and capital affect the rates of output; therefore, a clear understanding of the law of diminishing returns and its effect on labor estimation and capital estimation can help in tactical decision-making processes in a company. This concept can also support strategies to balance the input of labor and capital to maximize output.

Components of Marginal Product

The world of economics is vast and complex, but one of its vital components is the concept of the marginal product. Marginal product, put simply, is the additional output generated by a business when they add another unit of labor while keeping all other factors constant. Consider, for instance, a bicycle assembly line. If another worker is introduced to this production setup, the marginal product would be the number of extra bicycles produced as a result of that added labor.

The importance of marginal product in a business model can’t be overstated. It allows businesses to gauge their operations’ efficiency, enabling them to make necessary adjustments to optimize their productivity. For any change, whether it involves labor, capital, or any other aspect, business managers need to analyze its impact on output.

Several components make up a marginal product, including labor, physical capital such as machinery, and the managerial ability to coordinate these elements effectively. The change in productivity resulting from adding an extra input like labor or capital is critical to business growth and sustainability. Each unit of labor or capital that contributes positively to the output is a boon for the business.

However, a model that fails to account for the law of diminishing returns may end up being deceptive. As businesses increase input, they often reach a point where each extra unit contributes less to the output – the proverbial ‘too many cooks spoil the broth’ scenario in economics. That’s why it’s essential to understand the various components of marginal product and their delicate interplay for a complete picture of productivity in a business setting.

Understanding the Relationship Between Labor and Diminishing Returns

Understanding the dynamics of labor and diminishing returns is crucial when examining marginal productivity. Though a seemingly complex concept, it can be simply defined as the increase in output resulting from the addition of one more unit of input, say labor, while holding other factors constant. Sounds straightforward, right? To illustrate, suppose a dressmaker hires one extra employee, their output might increase by 10 units and that’s your marginal productivity.

However, here’s the catch – the relationship between labor and output isn’t linear. Our dressmaker can’t just go on hiring more staff expecting the output to keep rising in the same proportion. Why not, you ask? The answer lies in the law of diminishing returns. The dressmaker might see an increase in output initially, but after a certain point, the output levels start to plateau and then decrease. Essentially, productivity drops off after reaching maximum efficiency. This is when the additional units of labor start to produce less and less output.

Now, wonder why this happens? Several factors play a part. As the old adage goes: “Too many cooks spoil the broth.” Overcrowding and reduced efficiency among workers may take place, thereby blocking productivity. Understanding this helps firms in optimal resource management and decision-making. Being aware of diminishing returns safeguards against the inefficient deployment of resources, and the acknowledgment can empower businesses to strike a balance between deploying labor and managing output to increase business efficiency.

The knowledge of this relationship between labor and diminishing returns, thus, is vital for strategic business growth. Ignoring it is like sailing a ship without a compass. Whether you are just stepping into the world of economics or are a seasoned entrepreneur, understanding the importance of marginal productivity and diminishing returns in labor can help pave your path to success.

Role of Capital in Defining the Marginal Product

The role of capital plays a vital role in defining the marginal product. Often, we mistake capital as just the money needed for producing a product or service. However, in terms of marginal productivity, the meaning of capital extends to the resources used within the production process. These include machinery, technology, and raw materials, which, combined with labor, help in creating the final product.

The connection between capital and marginal product is primarily seen when we talk about units of inputs added to the production process. Have you ever noticed how adding more units of capital might bring an increase in productivity? That’s because each unit of capital typically allows us to create more units of product. As the product margin increases, this is a clear indication of positive returns from the additional units of capital input.

Yet, it shouldn’t be assumed that increasing capital will always yield higher marginal productivity. The principle of diminishing returns often comes into play, particularly when increasing amounts of capital are used without a proportional increase in other inputs. This means once a certain point is reached, adding more capital might actually reduce the marginal product.

In conclusion, understanding the intricacies of capital’s role in defining the marginal product is key to effective capital management within a company. It allows for the estimation of returns on investments and helps in managing resources efficiently. Sound knowledge of inputs, their relationship with the product marginal, and the impact of diminishing returns can prove instrumental for managers aiming to optimize productivity.

Marginal Product Calculation Formula and Example

Let’s delve a bit deeper into the nuts and bolts of economics now that we’ve covered the basics of marginal product, such as the role it plays in a company’s capital management and the relationship between labor and diminishing returns. In the theory of marginal product, one important component is the process of calculating it. The marginal product calculation isn’t as daunting as it seems, and we’ll illustrate this with an easy-to-follow formula and an example.

The marginal product is derived from the incremental units of input used in production. For instance, say you’re managing a factory that produces widgets and you’re trying to determine the productivity of your labor force. You can calculate marginal product by examining how many extra units of output you get when you add one more unit of labor. In this case, it can help a business or government make informed decisions about investment in these productive resources.

Here’s how it’s done using the marginal product calculation formula:

The marginal product is calculated by taking the difference in total output when one more unit of input is added, divided by the change in input units. So, if you add one more worker to the production line and it results in 10 more widgets being produced, your marginal product of labor is 10.

Hopefully, this clarifies the calculation process and demonstrates the practical application of the marginal product formula. Remember, it’s an essential economic theory that helps measure the effectiveness and efficiency of input in terms of output, and hence, aids both enterprises and governments in their strategic planning and investment. Once you’ve got the hang of it, it becomes a critical tool for understanding and optimizing production.

Capital Inputs and the Calculation of Marginal Product

Finding the marginal product is an essential segment of economics. It heavily revolves around the concept of capital inputs and their calculation to maintain the balance of productivity. Marginal product, simply put, is the additional output produced through the manipulation of a single unit of input without modifying the others. In this context, ‘input’ usually refers to labor or capital; when changed, it affects the overall output significantly.

Capital inputs are pivotal in dictating the marginal product. These include machinery, technology, or properties that aid in the production process. Such input is often a consideration for the government when it seeks to increase economic productivity. Since the inception of the field of economics, the correlation between capital inputs and increased production has been noticeably substantial, forming a significant part of its history.

Input, among various factors, is vitally important in determining the marginal product. As another unit of input is invested, it is expected to yield a subsequent increase in output. However, it’s also crucial to note that this relationship doesn’t always hold true, leading to the principle of diminishing returns. According to this principle, there is a point at which adding more inputs leads to a decreased output – a concept deeply embedded in the calculation of marginal product.

The essence of marginal product calculation includes understanding how inputs affect output. The formula for its calculation is marginally straightforward. The change in total product divided by the change in input quantity grants you the marginal product. This formula allows one to predict and estimate productivity levels and strategize effective production planning based on the data.

What Is the Law of Diminishing Marginal Productivity within a Company?

The law of diminishing marginal productivity plays a vital role in understanding how a company operates. This law observes that as units of one factor of production are increased, while all other factors are held constant, the incremental increase in output or productivity will eventually decline. Essentially, this theory suggests that there’s a point where adding more units, be it labor or capital, won’t yield proportionate increases in productivity. This is known as diminishing returns.

Flushed from the annals of economic history, the law of diminishing marginal productivity offers key insights into operational efficiency. Given its pertinence to planning, strategizing, and decision-making, its application extends from small businesses to government entities. A detailed understanding of this principle allows a company to manage resources optimally, especially regarding labor and capital. It is crucial in diagnosing the balancing point where the costs of adding more units outweigh the benefits, thereby leading to diminished productivity.

Within the broader context of economics, the law of diminishing marginal productivity also elucidates the interplay of various units and factors contributing to output. Hence, an accurate comprehension of its nuances could prove instrumental in a government’s policy framework, ensuring efficient use of resources for maximum possible output. The underpinning theory, combined with practical factors like capital inputs, labor, and their relationship to diminishing returns, provides an indispensable analytical tool for economic analysts, policy planners, and business strategists alike.

Indeed, the law of diminishing marginal productivity remains a central concept in understanding a company’s operational dynamics. By adhering to its principles, a company can effectively balance its resources to ensure optimal productivity and avoid the pitfalls of diminishing returns.

Connection Between Diminishing Returns and the Law of Marginal Productivity

In the economic realm, understanding the connection between diminishing returns and the law of marginal productivity is vital. The theory of marginal productivity states that as one factor of production increases, holding all other factors constant, the marginal product of that factor will eventually decline. This is very much tied to the concept of diminishing marginal returns.

Diminishing returns, also known as diminishing marginal returns, is a principle in economics that shows an economic output will reduce if one input is increased while others are held constant. The law of diminishing returns reinforces the law of marginal productivity. For instance, imagine a factory where workers are the only valuable input. As the factory continues to add more workers, the total output might increase but at a declining rate. This is the essence of diminishing returns.

The law of marginal productivity serves as a backbone for the theory of distribution in an economy. It decides how the total output will be distributed among the factors of production. Thus, it reflects how each unit of input contributes to the economy’s overall production. Understanding the connection between diminishing returns and marginal productivity law can give us insights into economic distribution and pricing mechanisms.

Through this connection, we can see how resources in our economy are allocated efficiently. It allows us to estimate the productivity of various factors, giving us a tactical advantage in decision-making processes. It also helps us understand the law of supply and demand better. In essence, the theory of diminishing returns forms an integral part of any economic theory and emphasizes the importance of the law of marginal productivity.

Marginal Product Examples in Real-World Companies

In the realm of business, the concept of marginal product is beneficial in a variety of ways. It is regarded as a cornerstone for companies as it aids in understanding the relationship between inputs, such as units of capital and labor, and outputs, like services and goods. Marginal product is a theory that many real-world companies use in their operations. Let’s delve into some examples to make this clearer.

Consider the example of a job where intense manual labor is the primary component. In a logistic company’s warehouse, for instance. Initially, adding more jobs dramatically increases the number of units handled every hour. However, as more jobs are added, the marginal product begins to decline, becoming a quintessential example of the law of diminishing marginal productivity. It highlights the relationship between labor and diminishing returns. In this case, the marginal product is the additional units handled due to adding one more worker.

Another example can be observed within the history of the automobile industry. Companies like Ford are classic examples of using labor and capital inputs to define the marginal product effectively. By investing intensively in automated machines, these firms were able to drastically improve their units of output, again illustrating the importance of capital in defining the marginal product.

Furthermore, the marginal product calculation formula is applied in real-world scenarios for decision-making. For instance, it helps companies determine whether investing in a new machine or hiring another worker will result in an increase in output.

Overall, by understanding and applying the concept of marginal product in a business context, real-world companies can create efficient strategies, balancing inputs and outputs, and optimizing productivity.

Economic Considerations for a Company’s Adoption of Economies of Scale

Let’s dive into the concept of economic considerations that drive a company‘s decision for the adoption of economies of scale. An integral part of this decision-making process stems from a firm’s goal to boost productivity. Companies aim to maximize output by optimizing the use of each unit of input employed. This is where the concept of marginal and total product rolls in.

The word marginal in marginal productivity denotes the extra output generated by an additional unit of input. On the other hand, the total product encapsulates the total output produced at a given time. But what does the government have to do with this and why is its role important?

Government policies can influence a firm’s decision regarding the adoption of economies of scale. Through conducive policies, the government has the power to nudge companies in the direction of reduced unit costs which, in turn, helps them achieve economies of scale. Herein lies the importance of understanding theory alongside real-world application.

Let’s consider a case in blue-collar industries such as manufacturing. For these businesses, especially, a clear understanding of marginal productivity helps in resource allocation, contributing significantly to success. In a nutshell, why economies of scale matter and how marginal productivity intertwines with it is the answer to many questions concerning efficient business operations, especially in an increasingly competitive market landscape.

So in simple terms, by marrying the theoretical aspect and real-world application of these economic concepts, companies can boost productivity, outshine their competitors, and ensure healthy profit margins.

Conclusion

Understanding the concept of marginal productivity is vital for both producers and economists. It is not only a measure of efficiency but also helps in making informed decisions about resource allocation and production management. The smart combination of labor and capital, driven by insights from marginal productivity, can result in optimal production output. Keep in mind, however, that the law of diminishing marginal productivity implies that the constant addition of a particular input resource may lead to lower levels of productivity at some point. This highlights the importance of balance within economic activities.

FAQ

Q: What is marginal productivity and why is it important?

A: Marginal productivity refers to the additional output gained by hiring an extra worker. It’s a vital concept in economics, helping to measure the effect of additional resources on overall output and indicating the point at which the highest level of output is achieved. It guides companies in their hiring and production decisions, informing them about the most efficient point of operation.

Q: What does the marginal productivity theory suggest about continuous hiring?

A: The marginal productivity theory suggests that while productivity might increase initially with the addition of more workers, it eventually decreases. This is because, at a certain point in continuous hiring, each additional worker will start to contribute less to the overall output due to stretched resources.

Q: What is the marginal product and how does it impact capital management?

A: The marginal product is the additional output that a business gains by adding an extra factor such as labor or capital. It has a direct impact on capital management, as it often increases when a company injects more capital into its operations. However, it’s important to note that the law of diminishing returns may apply after a certain point,

requiring clear comprehension of when and where the marginal product plateaus or even declines.

Q: How does the concept of diminishing returns relate to labor and capital estimation?

A: Diminishing returns occur when after a certain point, the incremental increase in output starts to decrease despite continual investment in labor or capital. Understanding this concept helps in making tactical decisions regarding labor and capital estimation, thus supporting strategies to balance these two factors for maximizing output.

Q: What role does capital play in defining marginal product?

A: Capital in terms of marginal productivity extends to include the resources used in the production process. Each unit of capital typically allows the creation of more units of product, thus leading to an increase in marginal productivity. However, the principle of diminishing returns often comes into play when increasing amounts of capital are used without a proportional increase in other inputs, meaning that at some point, adding more capital might actually reduce the marginal product.